hotlinia.ru

Market

Borrow Against Invoices

Invoice lending, also known as invoice financing or cashflow finance, is a type of small business funding option that's commonly used to promote positive. Invoice financing allows businesses to borrow against the value of their unpaid customer invoices. By selling invoices to a third party, you can unlock. Invoice financing is a form of short-term borrowing that allows you to receive a cash advance on your clients' unpaid invoices. Learn more in our guide. Factoring is a type of invoice financing where the outstanding debts owed to your business are sold in their entirety to a third-party lender. The new lender. To finance invoices, business owners can borrow money from a lender using client invoices as collateral. The lender will then “front” the business a. What is invoice finance? Invoice finance lets you use your unpaid invoices as security for funding. So, instead of waiting weeks or months to get paid, you. Invoice financing, also known as receivable financing or invoice trading, is a form of a loan. It is an asset-based loan that enables businesses to borrow money. Invoice factoring (also called accounts receivable financing) is one of the easiest financing sources to secure. It is a financial transaction where a business. Also called accounts receivable financing, invoice financing is when a company gets a cash advance from a financial institution (e.g. bank) based on unpaid. Invoice lending, also known as invoice financing or cashflow finance, is a type of small business funding option that's commonly used to promote positive. Invoice financing allows businesses to borrow against the value of their unpaid customer invoices. By selling invoices to a third party, you can unlock. Invoice financing is a form of short-term borrowing that allows you to receive a cash advance on your clients' unpaid invoices. Learn more in our guide. Factoring is a type of invoice financing where the outstanding debts owed to your business are sold in their entirety to a third-party lender. The new lender. To finance invoices, business owners can borrow money from a lender using client invoices as collateral. The lender will then “front” the business a. What is invoice finance? Invoice finance lets you use your unpaid invoices as security for funding. So, instead of waiting weeks or months to get paid, you. Invoice financing, also known as receivable financing or invoice trading, is a form of a loan. It is an asset-based loan that enables businesses to borrow money. Invoice factoring (also called accounts receivable financing) is one of the easiest financing sources to secure. It is a financial transaction where a business. Also called accounts receivable financing, invoice financing is when a company gets a cash advance from a financial institution (e.g. bank) based on unpaid.

Invoice financing is a way for businesses to borrow against unpaid invoices. With invoice financing, sometimes called accounts receivable financing. Accounts receivable loans or factoring loans are a form of business financing where a company uses its outstanding invoices as collateral to prevent. With invoice finance you can use the sales you've made as an asset to borrow against. It's simple, fast, and can be tailored to you. What is invoice finance? Invoice finance lets you use your unpaid invoices as security for funding. So, instead of waiting weeks or months to get paid, you. Invoice financing is a form of short-term borrowing in which your business borrows money against the amount due on invoices you've issued to your customers. Working with your accounting software, we receive an accurate picture of your business financials instantly and offer products which can either loan the value. Invoice factoring involves selling your invoices to a third-party lender at a discounted rate. Invoice discounting allows you to borrow against your invoices. Accounts receivable loans or factoring loans are a form of business financing where a company uses its outstanding invoices as collateral to prevent. Invoice finance is a form of funding available to businesses that uses their unpaid invoices as security to borrow money from a lender. Invoice financing is. Invoice financing is a type of business loan that's made based on the value of your outstanding invoices. Lenders who offer invoice financing for small business. Invoice financing allows B2B companies to use unpaid invoices as collateral in exchange for upfront cash. · This type of financing is best for industries that. Invoice financing means borrowing money against money that customers owe to your business. By using the invoices as a sort of security against a loan, invoice. Invoice factoring lets you sell your company's outstanding invoices at a discount to a third party (known as a “factoring company” or “factor”). When you sell. Invoice financing, also known as invoice discounting and accounts receivable financing, involves borrowing money against your company's outstanding invoices. Invoice finance is a finance facility that enables you to leverage your accounts receivable and unlock the cash tied up in your unpaid invoices. On payment of. A loan against (Asset Based Loan) or purchase of (Invoice Factoring) accounts receivables. Invoice financing allows you to access quick cash against current. What is invoice finance (IF)? Invoice financing (also known as invoice factoring) empowers businesses by advancing funds against unpaid invoices. This. Invoice finance, debtor finance or cash flow finance are generic terms for a range of products which, as the name suggests, help provide cash to fund the day-to. How Does Invoice-Based Financing Work? Invoice-Based Financing is a business loan secured by collateral, or assets. The loan is secured by accounts receivable. Invoice finance gives businesses access to the value of invoices that have been issued to customers, but not yet paid.

What Does A Mortgage Broker Do For You

:max_bytes(150000):strip_icc()/mortgage-broker1-4eb1e0febc8548dc8e1b26a407116fff.jpg)

A mortgage broker's primary responsibility is to educate their clients about different mortgage options and help them choose the best path. However, brokers can. A mortgage broker helps you understand the mortgage process and will try to get you the best deal for your circumstances. A mortgage broker is a person or company that can arrange a mortgage between you (the borrower) and a mortgage lender. Mortgage brokers can source mortgage products from different lenders, potentially saving you money. Mortgage brokers must hold a licence with RECA. But ultimately, it's a Mortgage Brokers job to find the lenders that will lend you enough for what you want to do. The lender that will lend you the most, might. They understand the intricacies of the mortgage market, including the latest products and lending criteria. Their guidance can help you navigate the complex. What mortgage brokers do · Understand your needs and goals. · Work out what you can afford to borrow. · Find options to suit your situation. · Explain how each loan. A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses. Traditionally, banks and other lending. What does a mortgage broker do? Mortgage brokers act as middlemen between borrowers and lending institutions, working on behalf of clients to find the best rate. A mortgage broker's primary responsibility is to educate their clients about different mortgage options and help them choose the best path. However, brokers can. A mortgage broker helps you understand the mortgage process and will try to get you the best deal for your circumstances. A mortgage broker is a person or company that can arrange a mortgage between you (the borrower) and a mortgage lender. Mortgage brokers can source mortgage products from different lenders, potentially saving you money. Mortgage brokers must hold a licence with RECA. But ultimately, it's a Mortgage Brokers job to find the lenders that will lend you enough for what you want to do. The lender that will lend you the most, might. They understand the intricacies of the mortgage market, including the latest products and lending criteria. Their guidance can help you navigate the complex. What mortgage brokers do · Understand your needs and goals. · Work out what you can afford to borrow. · Find options to suit your situation. · Explain how each loan. A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses. Traditionally, banks and other lending. What does a mortgage broker do? Mortgage brokers act as middlemen between borrowers and lending institutions, working on behalf of clients to find the best rate.

A mortgage broker is offered loans on a wholesale basis from lenders, and therefore can offer the best rates available in the market, typically making the total. Potentially extend your mortgage terms, so that your committed expenses are lower; Consolidate debt, again to reduce committed payments so you can borrow more. Mortgage brokers take on the responsibility of understanding both the borrower's financial standing and the available loan options in the market. They gather. What do mortgage brokers do? Mortgage brokers help you (and the people you're buying with) get the best possible deal, and ensure you choose a mortgage which. You will have to provide a completed loan application. Some brokers will come out to your home to take the application. You can fill one out yourself or use. Expert Guidance and Advice: A mortgage broker is a highly-trained professional who can offer you expert guidance and advice throughout the home. A mortgage broker may also help you to assess your financial situation and make an overall recommendation of the best mortgage for your needs. Unlike a bank. In layman terms, a mortgage broker is a person who acts as a middleman between you and the bank when you want to get a mortgage. A mortgage broker can be either. What do mortgage brokers do? Mortgage brokers help you (and the people you're buying with) get the best possible deal, and ensure you choose a mortgage which. A mortgage broker acts as an intermediary between borrowers and lenders, helping borrowers find the most suitable mortgage products based on their individual. A mortgage broker is an individual/organization that you hire to go out and find out what various mortgage options are available to you from a. What Does a Mortgage Broker Do? · Learning more about each client's finances and personal circumstances. · Researching and recommending options based on the. A mortgage broker refers to a middleman who manages the mortgage loan process for businesses or people. · A broker can assist a client with fee management in. A mortgage broker may also help you to assess your financial situation and make an overall recommendation of the best mortgage for your needs. Unlike a bank. A broker is a middleman. Mortgage brokers act as go-betweens for you and many different potential lenders. Instead of contacting several lenders yourself. A mortgage broker is someone who facilitates the connection between property buyers and an organization that can provide financing. A mortgage broker works with. The mortgage broker is the person who will sit with you, analyze your situation, and based on your profile, recommend the best lender for you to work with. The Mortgage Broker works as the liaison between the borrower and the lender to create a cost-effective and efficient loan process. Do Mortgage Brokers work for. A mortgage broker does not lend you money. Instead, they help you understand your loan options. Mortgage brokers can help you gather the documents you will need. A mortgage broker is apt to have broader knowledge of currently available loan products from a variety of lenders, and the prospective homebuyer can reasonably.

Buying A Car That Has A Loan On It

Whether you're going to a private or commercial buyer, here's a step-by-step guide on how to sell a financed car without paying it off. The seller is responsible for having the vehicle safety inspected by a licensed. Maryland inspection station. An automobile dealer, service station or. How Do You Buy a Car From Someone Who Has a Loan on It? · 1. Ask the Seller to Pay Off the Car Loan · 2. Pay Off the Seller's Loan · 3. Set Up an Escrow Account. The vehicle you choose also impacts the loan rate. Typically, car loans for new vehicles tend to be lower than car loans for used vehicles. This may not make. So, your vehicle's title has the lienholder on it, which is your lender. If you still have a loan on your vehicle, you need to remove that lien from the title. All you have to do is find a reliable dealership that has your best interests in mind. As long as you opt for a trusted brand like Family Auto, you can rest. Here is what you need to do before purchasing a car with a lien on the title. Log into your Swap Motors account and check your desired vehicle's CARFAX Vehicle. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan Are you having a hard time paying. In a loan, you agree to pay the amount financed, plus a finance charge, over a certain period of time. Once you're ready to buy a car from a dealer, you use. Whether you're going to a private or commercial buyer, here's a step-by-step guide on how to sell a financed car without paying it off. The seller is responsible for having the vehicle safety inspected by a licensed. Maryland inspection station. An automobile dealer, service station or. How Do You Buy a Car From Someone Who Has a Loan on It? · 1. Ask the Seller to Pay Off the Car Loan · 2. Pay Off the Seller's Loan · 3. Set Up an Escrow Account. The vehicle you choose also impacts the loan rate. Typically, car loans for new vehicles tend to be lower than car loans for used vehicles. This may not make. So, your vehicle's title has the lienholder on it, which is your lender. If you still have a loan on your vehicle, you need to remove that lien from the title. All you have to do is find a reliable dealership that has your best interests in mind. As long as you opt for a trusted brand like Family Auto, you can rest. Here is what you need to do before purchasing a car with a lien on the title. Log into your Swap Motors account and check your desired vehicle's CARFAX Vehicle. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan Are you having a hard time paying. In a loan, you agree to pay the amount financed, plus a finance charge, over a certain period of time. Once you're ready to buy a car from a dealer, you use.

Car Loan (also auto loan, car financing): A car loan is a contract between you and a lender where they agree to provide you with the cash to buy a new or used. When trading in a car with a loan balance, the car dealership that you are purchasing the new vehicle from would take over the loan, essentially buying the car. If you can hold off on buying a new vehicle, you can reduce your negative equity by making extra payments on the car loan. Delaying a trade-in is often the best. Once you've decided on a particular car you want to buy, you have 2 payment options: pay for the vehicle in full or finance the car over time with a loan or a. If you want to buy a vehicle that a seller still owes money on, the safest bet may be to pay off the lender directly to satisfy the outstanding loan balance. Flexibility: Auto loans are generally only available if you're buying a car from a dealership. · Fast access: You can generally receive the funding for a. You can't trade in your vehicle if there is a lien on your title. You will need a statement from the lienholder stating that the loan has been paid in full. The short answer is yes! There's no need to stress if you are ready to purchase a new or used car but still have a car loan on the one you currently own. If your vehicle is worth more than you owe, you'll receive the difference, or you can apply it toward the purchase of your next vehicle from Carvana. Was this. Car Loan (also auto loan, car financing): A car loan is a contract between you and a lender where they agree to provide you with the cash to buy a new or used. You'll have to conclude if it makes sense to trade in a financed car or to wait until you've paid off the loan to purchase another vehicle. Your options include. As long as any finance arrangement is out in the open, there's really no problem with buying a car that's still subject to a loan. A car loan for a private sale can help you buy a car from an individual when you can't cover the purchase price upfront. When dealership cars aren't exactly. You can use a personal loan to buy just about anything, including a car. They give a borrower a lot of flexibility. Can I Trade In a Car With Negative Equity? If you're interested in trading in your upside-down car, some dealerships will offer to pay off the loan for you. Once you've decided on a particular car you want to buy, you have 2 payment options: pay for the vehicle in full or finance the car over time with a loan or a. Even if you feel confident you can afford the car loan and a new mortgage payment, a DTI that's too high may disqualify you from getting a home loan. #3: New. If you can't afford cash, a personal loan is usually the cheapest way to finance a car deal – but only if you have a good credit score. You can get a personal. If your vehicle is worth more than you owe, you'll receive the difference, or you can apply it toward the purchase of your next vehicle from Carvana. Was this. Flexibility: Auto loans are generally only available if you're buying a car from a dealership. · Fast access: You can generally receive the funding for a.

Who Has The Best Reloadable Debit Card

True Link Financial has a card like this, you load it and that is what they an spend. The Bluebird Prepaid Debit Card by American Express lets you easily manage your money with no monthly fees. Add cash for free at Walmart, pay bills & more. The reloadable Visa Prepaid card is the quick, easy, and secure way to pay online or in person. Learn more about the all-purpose Visa Prepaid card here. Debit and prepaid cards have been around a while, so you might think you know all their benefits. However, with AbbyBank, Visa and Mastercard. The Navy Federal GO Prepaid Card is the perfect solution for easy budgeting. No hidden fees. No monthly fees. No purchase fee. No activation fee. Earn up to $75 cash back every year on your Walmart purchases. Learn about the Walmart MoneyCard reloadable debit card account, click here! Best of all, there are no monthly fees!* Experience the convenience and savings of Walmart's reloadable debit cards today. Start banking your way and enjoy. NetSpend® Visa® Prepaid Card · No credit checks · No minimum balances · No-cost direct deposit + get paid two days faster · Reload at over , locations. The best prepaid and debit cards of · + Show Summary · Netspend® Visa® Prepaid Card · Netspend® Visa® Prepaid Card · Self - Credit Builder Account with Secured. True Link Financial has a card like this, you load it and that is what they an spend. The Bluebird Prepaid Debit Card by American Express lets you easily manage your money with no monthly fees. Add cash for free at Walmart, pay bills & more. The reloadable Visa Prepaid card is the quick, easy, and secure way to pay online or in person. Learn more about the all-purpose Visa Prepaid card here. Debit and prepaid cards have been around a while, so you might think you know all their benefits. However, with AbbyBank, Visa and Mastercard. The Navy Federal GO Prepaid Card is the perfect solution for easy budgeting. No hidden fees. No monthly fees. No purchase fee. No activation fee. Earn up to $75 cash back every year on your Walmart purchases. Learn about the Walmart MoneyCard reloadable debit card account, click here! Best of all, there are no monthly fees!* Experience the convenience and savings of Walmart's reloadable debit cards today. Start banking your way and enjoy. NetSpend® Visa® Prepaid Card · No credit checks · No minimum balances · No-cost direct deposit + get paid two days faster · Reload at over , locations. The best prepaid and debit cards of · + Show Summary · Netspend® Visa® Prepaid Card · Netspend® Visa® Prepaid Card · Self - Credit Builder Account with Secured.

Recieve 1% unlimited cash back with the Serve Cash Back Visa debit card or enjoy free cash reloads with the Serve Free Reloads Visa debit card. You can make the best choice about which card is right for you when you understand key differences. A reloadable prepaid card allows you to add more money. This. The Transact prepaid card is reloadable & simple to use anywhere that Debit Mastercard is accepted. Paying with Prepaid Card. Bill. Learn more about the PayPal Prepaid Mastercard, a reloadable card with rewards & a savings account. Order today. Reloadable Debit Cards · Scarlet Bank Account and Mastercard Debit Card · Green Dot Visa Debit Cards · GO2bank Visa Debit Card · Serve · Netspend Visa Prepaid Card. Looking for a prepaid reloadable card with no overdraft fees? Don't want to open a new bank account? Our Now Card is the perfect card for your needs. Reloadable debit cards are cards that allow you to choose how much money to fund them with. When the cards are used to make purchases, the money is subtracted. A reloadable debit card is not associated with an interest earning checking account, but enables cardholders to "load" money onto the card through methods. We'd love to have your feedback on the best no fee prepaid debit cards for , including low fee prepaid cards (each card review has a customer opinion. 's Best Prepaid Debit Cards - Editors' Picks ; Prepaid Debit Card for Travel, Bluebird® American Express® Prepaid Card, $0 Foreign Transaction Fees ; Prepaid. ONE VIP · NetSpend Visa Prepaid Card · smiONE™ Visa® Prepaid Card · ACE Elite Prepaid Debit Card · hotlinia.ru Prepaid Visa® Card · Not sure if a prepaid card is right. A reloadable debit card, also referred to as a prepaid debit card, is a card that you can use to make purchases. They are sold at grocery stores, pharmacies. Top 5 Prepaid Cards With Convenient ATM Access · 1. PayPal Prepaid Mastercard · 2. Netspend Visa Prepaid Card · 3. The Mango Prepaid Mastercard · 4. Bluebird. The Netspend® Visa® Prepaid Card is issued by Pathward™, National Association, Member FDIC. Pursuant to a license from Visa U.S.A. Inc. The PayPal Prepaid. Some good choices include the Amex Serve FREE Reloads card, the Bluebird by American Express card, and the Walmart MoneyCard. All of these cards. Looking for a prepaid reloadable card with no overdraft fees? Don't want to open a new bank account? Our Now Card is the perfect card for your needs. Sometimes a prepaid Visa card is suggested as a means to protect money from being garnished. A prepaid Visa card looks like a credit card but is entirely. No interest. No credit checks. No deposit required. Use your bank—keep your money where you want, while spending smarter with Extra. The Extra Debit Card is. Prepaid cards by Mastercard provide more convenient, safer & smarter options to pay than cash. Get Mastercard reloadable prepaid cards for secure payments.

How To Invest In India Stock Market From Usa

NRIs living in the United States can invest online in Indian Stock Exchanges. They can invest in equities, equity derivatives, currency derivatives. The two primary exchanges where you can trade in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). You can read more about. The easiest way to invest in the whole Indian stock market is to invest in a broad market index. This can be done at low cost by using ETFs. Yesterday, it was a quiet start to the final week of trading in the month of August with US equity markets struggling to hold opening gains. Most major. India's stock market is setting up for the longest bull run in its history. Increased domestic investment in stocks, growing social equity and other factors. Investments are usually made with an investment strategy in mind. New York Stock Exchange · London Stock Exchange · National Stock Exchange of India. TLDR: Investing in Indian stocks via a Indian demat account is best for NRIs with income or inheritance in India. Sending CAD for INR conversion. Explore the world of US stock market investing from India. Learn the steps, requirements, and strategies to build a diversified portfolio by investing in US. Do you convert to INR and buy using NRI Trading accounts or do you buy US ETFs which track the Indian market? Any pros/cons for either of the. NRIs living in the United States can invest online in Indian Stock Exchanges. They can invest in equities, equity derivatives, currency derivatives. The two primary exchanges where you can trade in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). You can read more about. The easiest way to invest in the whole Indian stock market is to invest in a broad market index. This can be done at low cost by using ETFs. Yesterday, it was a quiet start to the final week of trading in the month of August with US equity markets struggling to hold opening gains. Most major. India's stock market is setting up for the longest bull run in its history. Increased domestic investment in stocks, growing social equity and other factors. Investments are usually made with an investment strategy in mind. New York Stock Exchange · London Stock Exchange · National Stock Exchange of India. TLDR: Investing in Indian stocks via a Indian demat account is best for NRIs with income or inheritance in India. Sending CAD for INR conversion. Explore the world of US stock market investing from India. Learn the steps, requirements, and strategies to build a diversified portfolio by investing in US. Do you convert to INR and buy using NRI Trading accounts or do you buy US ETFs which track the Indian market? Any pros/cons for either of the.

Join the millions of people using the hotlinia.ru app every day to stay on top of the stock market and global financial markets! Yesterday, it was a quiet start to the final week of trading in the month of August with US equity markets struggling to hold opening gains. Most major. 3. Complement your portfolio: Use to customize your emerging market exposures with a targeted exposure to India. When you invest in stocks (also called equities), you buy a share in a company and become a shareholder. Equities are typically more appropriate for long-term. NRIs living in the United States can invest online in Indian Stock Exchanges. They can invest in equities, equity derivatives, currency derivatives, mutual. Indian brokers also offer exchange-traded funds as investment options directly from a local market. Do remember to make that the ETF you choose to invest in is. However, they can invest in Indian stocks through exchange-traded funds (ETFs) listed in the US and other countries. This is the easiest way for most foreign. Non-resident Indians (NRIs) can also invest in US Stocks with Vested. To open an account with Vested, NRIs need to provide their PAN card or passport, proof of. In our opinion, out of these three options, US-focused index funds viz Motilal Oswal Nasdaq FOF and Motilal Oswal S&P Index funds are the cleanest and. Invest in US Stock Market: Easily invest in US stocks from India with 0 Brokerage. Open your Demat Account and invest in global market with Motilal Oswal. US is the 3rd largest investor in India with FDI Investment of $ Bn from Apr to Mar · Imports from US to India in were valued at $ Bn. To buy US stocks, you need to open a trading account with a brokerage firm that offers international trading services. There are several online. investment returns and share prices will fluctuate on a daily basis. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual. Vested is a US Securities and Exchange Commission Registered Investment Advisor. Through this online platform, investors from India and NRIs can invest in US. Many leading stock exchanges are based outside of the U.S., offering investors potential to expand and diversify their portfolios with securities in both. MSIM was an early mover in emerging markets, first investing in the asset class in , originally in emerging Asia. We were one of the first foreign. Ease of access: India ETFs are easily accessible through major stock exchanges, allowing investors to buy and sell shares like individual stocks. Cost. For example, through mutual funds and a mobile app. This article covers why and how to invest in the US stock market from India in detail. Why should you invest. Instead of using a domestic broker, you can directly open an account with a foreign broker that provides access to the U.S. stock market. This may offer more. Access 5,+ US Stocks and ETFs · Take your portfolio global, starting at just $1 · Buy less than a share, open your account in minutes.

Welcome Bonus Checking Account

Earning up to a $ cash bonus is easy. · Open your checking account · Set up Direct Deposits · Earn up to a $ cash bonus · Explore checking account options. Or open a new, eligible consumer checking account at a Wells Fargo branch with a minimum opening deposit of $25 by September 30, You must provide the. Complete the qualifying requirements to receive your $ bonus. This offer is for new checking customers only. See how to avoid the $10 monthly service fee. Requirements to receive the $ cash bonus: (1) Open a new primary checking account between 06/17/24 and 08/31/24 with an opening deposit of $25 or more. (2). Skip the wait with direct deposit. Have your paycheck deposited automatically. Start earning interest when you set up $1, deposits.*. Earn a $ welcome bonus. when you make qualifying ACH deposits totaling $2,+ within 60 days of opening your account. To qualify for the $ checking bonus, provide the offer code, open a Fifth Third Momentum® Checking, or Preferred2 checking account by 9/30/ and make. Become a member at Purdue Federal Credit Union and earn a $ bonus by simply opening a new checking account with direct deposit and enrolling in paperless. Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring. Earning up to a $ cash bonus is easy. · Open your checking account · Set up Direct Deposits · Earn up to a $ cash bonus · Explore checking account options. Or open a new, eligible consumer checking account at a Wells Fargo branch with a minimum opening deposit of $25 by September 30, You must provide the. Complete the qualifying requirements to receive your $ bonus. This offer is for new checking customers only. See how to avoid the $10 monthly service fee. Requirements to receive the $ cash bonus: (1) Open a new primary checking account between 06/17/24 and 08/31/24 with an opening deposit of $25 or more. (2). Skip the wait with direct deposit. Have your paycheck deposited automatically. Start earning interest when you set up $1, deposits.*. Earn a $ welcome bonus. when you make qualifying ACH deposits totaling $2,+ within 60 days of opening your account. To qualify for the $ checking bonus, provide the offer code, open a Fifth Third Momentum® Checking, or Preferred2 checking account by 9/30/ and make. Become a member at Purdue Federal Credit Union and earn a $ bonus by simply opening a new checking account with direct deposit and enrolling in paperless. Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring.

To receive the $ bonus: Open a Basic, Simple, Fresh Start, or Fresh Start Pro checking account, make an electronic deposit* of $ or more within the first. Eligible Primary and Free Checking accounts must have an average balance of $1, or more for days after account opening. Bonus will be paid directly to. Enjoy up to $ bonus when you open a qualifying checking account. See Round up your purchases to the next whole dollar amount and we'll deposit the. Direct Deposit bonus: Earn $ for direct deposits totaling $2, or more across two consecutive statement cycles within the first three statement cycles from. Earn up to $ checking account bonus simply by applying online. Choose the checking account right for you and apply today. Earn a cash bonus in three steps: · Open a new eligible business checking account by December 31, · Deposit $5, or more in New Money* directly into your. Bonus Deposit Requirements: To be eligible for the $ bonus, the account must meet these requirements within 60 calendar days after the account opening date. The 10 best checking account bonuses of August Customer will receive a $ reward when they open their first personal checking account opened in-branch (offer applies to Foundation, Elevation and Pinnacle. Huntington Bank: Huntington Perks Checking - $ · Truist: Truist One Checking - $ · Citizens Bank: Citizens One Deposit Checking - $ · Chase: Chase Total. Earn up to a $ cash bonus when you open a new SoFi Checking and Savings account online with direct deposit. Take advantage of this promotion today! Enjoy up to a $ Bonus Learn which of our checking account options is right for you and open your account today and complete the qualifying activities below. $ CHECKING OFFER: Start by opening a new eligible checking account today. See offer details. Eligible Primary and Free Checking accounts must have an average balance of $1, or more for days after account opening. Bonus will be paid directly to. Earn $ in two easy steps. Open a FirstView or SmartView checking account. Make qualifying direct deposits totaling $ within the first 90 days. Get a $ cash bonus when you open a new Relationship Checking account and have a cumulative total of $7, in qualifying direct deposits within 90 days of. You can receive only one new checking account opening related bonus every two years from the last coupon enrollment date and only one bonus per account. Coupon. Who qualifies: You must be a First Tech Credit Union member without any direct deposits in the last 18 months. What you need to do: Set up a direct deposit from. New student checking customers can earn a $ bonus with qualifying activities. Yours to earn with a new TD savings account and qualifying activities. Open. Earn up to a $ bonus when you open a new, eligible US Bank business checking account online with promo code Q3AFL24 and complete qualifying activities.

Are Timeshares A Good Investment

Timeshare is not an investment to gain money on and it might lose money value buy resale is a must. You will get a mfee each year. A timeshare is not an investment. Investments are designed to appreciate in value, generate income, or do both. A timeshare is unlikely to do either, despite. No, it's never a good idea to buy a timeshare. The math simply doesn't work in your favor. The never ending maintenance fees and the transfer. If you still think buying a timeshare is a good idea, and you want to avoid paying more than you will ever sell it for, buy one on the secondary. A timeshare is a vacation residence divided between a group of owners, with different types of timeshares suiting different needs. Here's a breakdown of the. Timeshares can be very worthwhile investments. It is not only a practical piece of real estate for the reason that it is a residence standing by whenever you. The only way to consider a timeshare a worthwhile investment is if you look at it from the perspective of a timeshare resort. They invest time and money into. The timeshare resort industry's sales pitch isn't only misleadingly, but outright criminal. Using well known terms like "deeded", it's given the sales reps the. Timeshares offer vacationers the opportunity to use a vacation property for a limited amount of time each year. While these may sound like great deals. Timeshare is not an investment to gain money on and it might lose money value buy resale is a must. You will get a mfee each year. A timeshare is not an investment. Investments are designed to appreciate in value, generate income, or do both. A timeshare is unlikely to do either, despite. No, it's never a good idea to buy a timeshare. The math simply doesn't work in your favor. The never ending maintenance fees and the transfer. If you still think buying a timeshare is a good idea, and you want to avoid paying more than you will ever sell it for, buy one on the secondary. A timeshare is a vacation residence divided between a group of owners, with different types of timeshares suiting different needs. Here's a breakdown of the. Timeshares can be very worthwhile investments. It is not only a practical piece of real estate for the reason that it is a residence standing by whenever you. The only way to consider a timeshare a worthwhile investment is if you look at it from the perspective of a timeshare resort. They invest time and money into. The timeshare resort industry's sales pitch isn't only misleadingly, but outright criminal. Using well known terms like "deeded", it's given the sales reps the. Timeshares offer vacationers the opportunity to use a vacation property for a limited amount of time each year. While these may sound like great deals.

Unless you plan to visit your home resort over and over again, I don't think owning a timeshare makes sense, even one purchased on the resale market. An. Timeshares cannot be considered as financial investments because their worth decreases in time and become a liability. This is because timeshares simply mean. Timeshares are not considered investment properties. Unlike a house, timeshares typically decrease in value over time. The only good thing about timeshares are the free trips they offer to go listen to the same sales pitch. The timeshares themselves are never. Timeshares are not a good investment. You are lock into a contract that will last a very long time and it is almost impossible to get out of the. No, it's never a good idea to buy a timeshare. The math simply doesn't work in your favor. The never ending maintenance fees and the transfer. For those looking into vacation ownership, timeshare resales are a great option to save money while still getting most of the same benefits. We've broken. Timeshare properties usually have resort-like amenities and services and are professionally managed. Compared with a typical hotel room, a timeshare property is. Americans are notorious for giving up vacation time. When you buy a timeshare, you're making a significant upfront investment and may be more motivated to take. When you buy in a property-type timeshare, you will pay the purchase price, taking on an annual commitment. You will pay maintenance fees and your share of. It is crucial to note that timeshares should not be viewed as investments. Unlike traditional real estate, timeshares do not appreciate in value or yield income. Among the concerns of potential timeshare purchasers is whether such a purchase is a good investment. Keep in mind timeshares are not a financial investment. While many sales reps tout a timeshare as an excellent “investment,” these vacation leases fail to meet the one critical criterion — gaining value over time. While not guaranteed, in fact, most won't, some timeshares will appreciate in value over time, offering the potential for a return on investment. 8. Cheaper. Are you considering whether or not a timeshare is a good idea for you? Check out this guide to finally get the answer to the burning question: are. Timeshare investments would be bad investments, if they could be considered investments at all. Unlike a home or most other deeded real estate interests. The State of the Timeshare Industry · Timeshare Industry: Almost Bought A Timeshare Due To Aggressive Sales · Read The Timeshare Contract Carefully · Solutions. They may not represent a great investment for you. In spring , an eye-catching blog post appeared at hotlinia.ru, reporting that the number of. Timeshares Are Typically Not a Good Investment There are few buyers looking to purchase a timeshare in the after-market, which makes them very difficult to. Is it worth the investment? A timeshare is not exactly an investment in the sense that it does not appreciate in value over time. In fact, in case you want to.

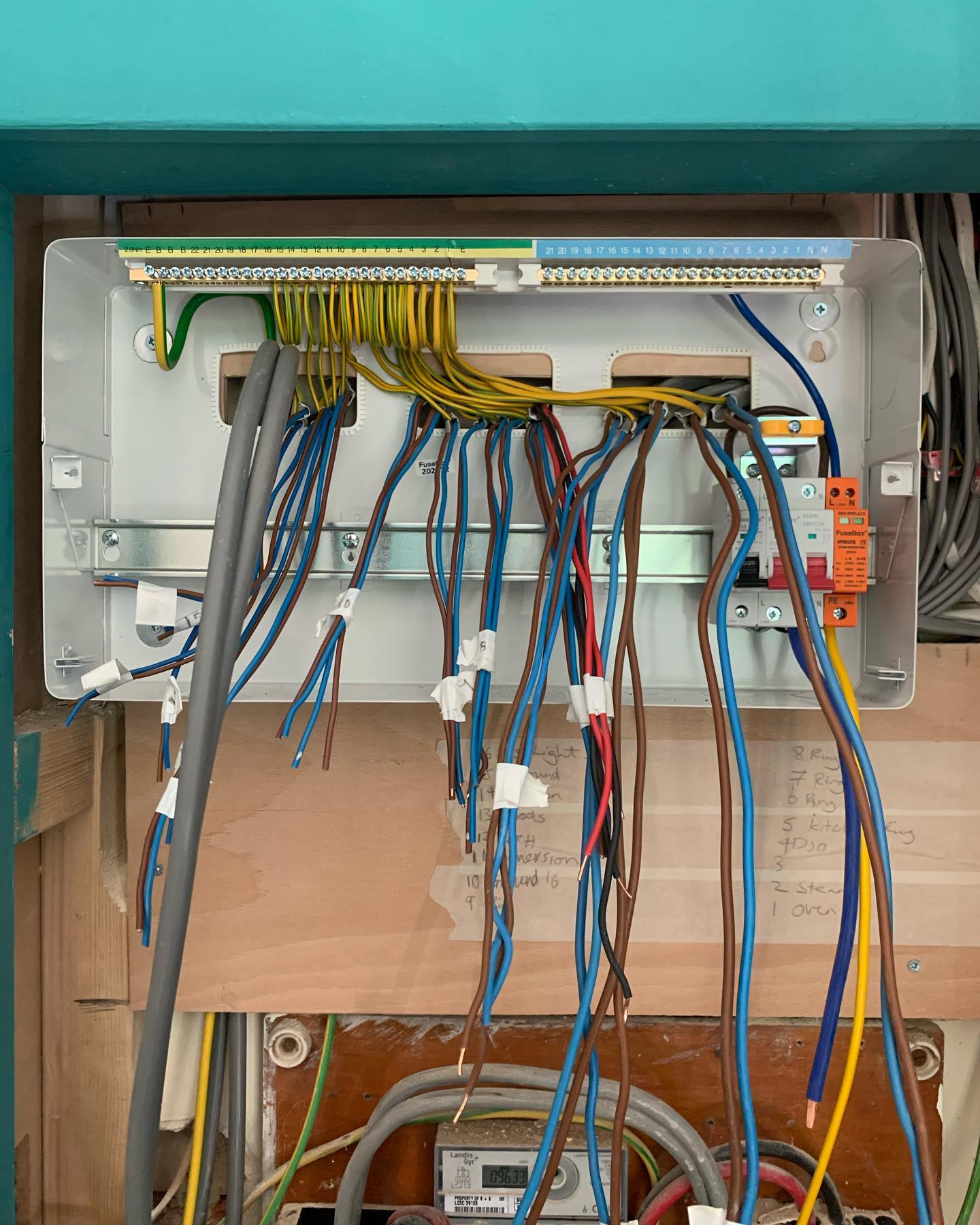

How Much Does It Cost To Get Your House Rewired

The average cost to rewire a house is between $8 and $12 a square foot. In electrical rewiring, all the current wires are removed and replaced with new. Get a free and instant quote using our house rewiring cost calculator. Get Your Home Rewire Quote Cost. Get A Quote Now. How Much Does Rewiring Cost? Rewiring a sq. ft. house usually costs between $6, and $12,, depending on the complexity and local rates. Hope that helps you out! If. Looking to rewire your home but don't know where to start? We get it, for most people, the thought of getting their house rewired strikes fear in them because. A wiring upgrade on a small home that has been gutted to its studs might cost less than $4, while rewiring a larger or finished home could cost $10, or. In general, however, homeowners can expect to pay between $2, and $10, for a complete electrical rewire. A larger home of sq ft would cost. It could cost from $9, to $15, to rewire that size house, according to some estimates, but others put the cost much lower. In any case, the age of the. The cost to rewire a house ranges between $12, and $20,, or an average of $16, Rewiring costs are typically priced per square foot, with the average. Electrical wiring isn't just about the cost of materials; it's also about the space you're covering. Wiring costs can range from $ to $ per linear foot. The average cost to rewire a house is between $8 and $12 a square foot. In electrical rewiring, all the current wires are removed and replaced with new. Get a free and instant quote using our house rewiring cost calculator. Get Your Home Rewire Quote Cost. Get A Quote Now. How Much Does Rewiring Cost? Rewiring a sq. ft. house usually costs between $6, and $12,, depending on the complexity and local rates. Hope that helps you out! If. Looking to rewire your home but don't know where to start? We get it, for most people, the thought of getting their house rewired strikes fear in them because. A wiring upgrade on a small home that has been gutted to its studs might cost less than $4, while rewiring a larger or finished home could cost $10, or. In general, however, homeowners can expect to pay between $2, and $10, for a complete electrical rewire. A larger home of sq ft would cost. It could cost from $9, to $15, to rewire that size house, according to some estimates, but others put the cost much lower. In any case, the age of the. The cost to rewire a house ranges between $12, and $20,, or an average of $16, Rewiring costs are typically priced per square foot, with the average. Electrical wiring isn't just about the cost of materials; it's also about the space you're covering. Wiring costs can range from $ to $ per linear foot.

The basic cost to Re-Wire a Home is $ - $ per residence in August , but can vary significantly with site conditions and options. How much does it cost to rewire a house in , get your quote instantly here online. 2 bed house £, 3 bed £, 4 bed £ Cost factor #5: Whether your home needs an electrical panel upgrade. Unfortunately, most homes that need to be rewired also need to upgrade their main. The average cost to rewire a 2 bedroom flat or maisonette is between £3, – £4, plus VAT. Of course if you have more or less rooms the cost will work out. The cost to rewire a sq. ft. house typically ranges from $8, to $15,, depending on factors like the complexity of the job and your. So, how much does it cost to rewire a house? Factors that will affect the Call Now to Find Out the Cost to Rewire a House in Your Neighborhood. If. The estimated cost range to install wires into your new home will probably be around $3 to $5 per square foot. Newly constructed homes will result in new wiring. On average, you're looking at around $7, to $11, for a 1, sq. ft. house. That breaks down to roughly $7 to $11 per square foot. But remember, these. In the United States an average cost of rewiring a house is around $ – $ for a regular household. This price includes the materials, labor and the. Cost Factor #2: Home's Age & Size The age and size of the house are critical factors that influence the cost of rewiring. Older homes may have outdated wiring. The average cost to rewire a house in the United States is $2, However, this price can vary significantly depending on the size and age of the home, as well. According to Angie's List, the average cost of rewiring a 1, to 3,square foot home ranges from $8, to $15, The good news is that this is a one-. Dedicated circuits for larger appliances could cost between $ and $ depending on distance and degree of difficulty. The most expensive part of your. If you opt to get new wiring for your home, you should expect to pay between $ and $ per square foot. If you're wiring a new house or rewiring an old. The average cost to rewire a 3-bedroom semi-detached house is around £3, and can typically take up to 10 days to complete. Generally, prices can typically. WORK WITH HEDGEHOG ELECTRIC ON YOUR HOUSE REWIRING. If you live in Salt Lake City, down to Southern Utah, you don't have to gamble when it comes to working with. The average cost of a house rewiring project is about $2, However, the price may vary between $1, to $10, depending on the materials, labor, and. The copper wire used to rewire a house is expensive and can cost around $1, for an average home, and $3, for a larger home. Rewiring your home will. The copper wire used to rewire a house is expensive and can cost around $1, for an average home, and $3, for a larger home. Rewiring your home will. Get Your Home Rewire Quote Cost. Get A Quote Now. How Much Does Rewiring If you're wondering, “How much does house rewiring cost?”, we've outlined.

How Much Is Cigna Dental Insurance

To see how your savings may be greater when visiting a. Cigna DPPO Advantage Network provider, see the. Summary of Benefits. Cigna Dental Preventive plan MD. You can find DPPO Advantage dentists by searching our network directory, and you can compare out-of-pocket costs for dentists when you search on hotlinia.ru $39 average monthly premium · $0 routine dental check-ups, including cleanings and routine x-rays · $50 individual and $ family annual deductible apply to. How much do dental implants cost with Cigna insurance. As of , plans with surgical dental implant coverage are available. Prior authorization may be. With the Cigna Dental Care® plan, you get comprehensive dental coverage that's easy to use. At a wallet-friendly price. Now that's something to smile about. Cigna Coverage Availability & Fees · Cigna Dental This plan covers preventive care at % and provides up to $1, worth of restorative care (such as. Many dental plans cover % for preventive dental services aside from a copay at the time of the visit. When choosing a full coverage dental plan, read the. Cigna dental insurance is a traditional fee-for-service plan. In exchange for a premium that you pay monthly, you are eligible to receive certain benefits for. Around $5, in benefits are available and can be applied towards both minor and major dental procedures, like fillings, crowns, and root canals. With Cigna. To see how your savings may be greater when visiting a. Cigna DPPO Advantage Network provider, see the. Summary of Benefits. Cigna Dental Preventive plan MD. You can find DPPO Advantage dentists by searching our network directory, and you can compare out-of-pocket costs for dentists when you search on hotlinia.ru $39 average monthly premium · $0 routine dental check-ups, including cleanings and routine x-rays · $50 individual and $ family annual deductible apply to. How much do dental implants cost with Cigna insurance. As of , plans with surgical dental implant coverage are available. Prior authorization may be. With the Cigna Dental Care® plan, you get comprehensive dental coverage that's easy to use. At a wallet-friendly price. Now that's something to smile about. Cigna Coverage Availability & Fees · Cigna Dental This plan covers preventive care at % and provides up to $1, worth of restorative care (such as. Many dental plans cover % for preventive dental services aside from a copay at the time of the visit. When choosing a full coverage dental plan, read the. Cigna dental insurance is a traditional fee-for-service plan. In exchange for a premium that you pay monthly, you are eligible to receive certain benefits for. Around $5, in benefits are available and can be applied towards both minor and major dental procedures, like fillings, crowns, and root canals. With Cigna.

The Cigna Dental Savings® program is an affordable alternative to traditional dental insurance that can help you and your family save up to 40%* off dental care. When covered services are rendered by an in-network provider, Cigna reimburses the dentist according to the schedule while plan participants usually have no out. To see how your savings may be greater when visiting a. Cigna DPPO Advantage Networkprovider, see the. Summary of Benefits. Cigna Dental Preventive plan · Cigna. Dental PPO · Student only: $ · Student with one dependent: $ · Student with two or more dependents: $ Cigna dental savings plans start at just $ for a year's worth of savings. That breaks down to less than $11 a month, which is what you would spend on one. Cigna Dental Savings® is a low-cost alternative to traditional dental insurance and offers up to 40%* off of quality dental services. To find a participating. Cigna Dentist In-Network – Prosper, TX. How Cigna Dental Insurance Can Help You. Young man with his arms crossed and smiling after seeing a Cigna dental in-. Call us at Our knowledgeable customer service team will assist you with any questions you may have prior to enrolling in a dental plan. They can. Offered by Cigna Health and Life Insurance Company or Connecticut General Life Insurance Company. d 03/16 (DPPO Advantage). Page 2. Understand how your. All group dental insurance policies and dental benefit plans contain exclusions and limitations. For costs and details of coverage, review your plan documents. Dental. $ annual deductible for individuals; $2, in dental benefits per calendar year ; Vision. No deductible and no waiting period; Vision exams covered. Dental Plans are insured by Cigna Health and Life Insurance Company with network management services provided by Cigna Dental Health, Inc. Rates may vary based. Most in-network preventive dental care, like cleanings, routine exams, and routine X-rays, is covered at %. You may be required to pay a copay at the time of. coverage from a valid dental insurance plan which included coverage For costs and additional details about coverage, contact Cigna Health and Life Insurance. Cigna Coverage Availability & Fees · % preventive care (cleanings, exams, X-rays, fluoride treatment, sealants) · 80% basic procedures (fillings, tooth. Product Details · $50 annual deductible for individuals, $ annual deductible for families · $1, in dental benefits per calendar year · $0 dental check-ups. Your Cigna Dental Benefit Plan · Restorative dentistry like fillings and crowns receive between 50 and 80% coverage · Tooth replacement solutions like bridges. Cigna network. How much you pay for dental services depends on how long you have worked for the County, your represented group, and whether you choose a. This amount is generally between $ and $1, per person. With help from our team, you can reduce your out of pocket costs and get the most from your annual. Estimated costs without dental coverage may vary based on location and dentists' actual Cigna DHMO plans are provided by Cigna Dental Health Plan of.

Infinity Kingdom Discord

Infinity Kingdom is a cartoon-style MMO strategy game. Players must defend the land of Norheim against the evil gnomes while protecting themselves from. We are looking forward to seeing your feedback, whether on the game forums or on Discord. We will take it into account with regard to future new features and. Join our Discord to stay close with your friends in Infinity Kingdom! Here are the bonuses that you can get from our Discord server! 1. There is one that is named Mik in discord, I reserve his full name for privacy. Buggy game isn't up to ROK,COD,SOS or Infinity kingdom standards. This game. Tackling the same challenges as Tears of the Kingdom presented, but in Breath of the Wild. Meeko on my Discord Server for testing Steamdeck. Switch. List of Discord servers tagged with rise-of-kingdom. Find and join some infinity-kingdom · ts-gaming. سيرفر كومينتي عربي متخصص في جيمرز عرب ويتوتبرز. The game developers have an excellent support structure. They run a discord server with a ton of members and it's really easy to get feedback. I've also. Infinity Kingdom Discord Server · Infinity Discord Server · SK8 the Infinity Discord Bots and Discord Servers and its trademarks are © Discord Inc. Isekai Craft is a Malaysia minecraft Server that located at Singapore. We also discussing about anime manga and cosplay. Join our Discord for more further. Infinity Kingdom is a cartoon-style MMO strategy game. Players must defend the land of Norheim against the evil gnomes while protecting themselves from. We are looking forward to seeing your feedback, whether on the game forums or on Discord. We will take it into account with regard to future new features and. Join our Discord to stay close with your friends in Infinity Kingdom! Here are the bonuses that you can get from our Discord server! 1. There is one that is named Mik in discord, I reserve his full name for privacy. Buggy game isn't up to ROK,COD,SOS or Infinity kingdom standards. This game. Tackling the same challenges as Tears of the Kingdom presented, but in Breath of the Wild. Meeko on my Discord Server for testing Steamdeck. Switch. List of Discord servers tagged with rise-of-kingdom. Find and join some infinity-kingdom · ts-gaming. سيرفر كومينتي عربي متخصص في جيمرز عرب ويتوتبرز. The game developers have an excellent support structure. They run a discord server with a ton of members and it's really easy to get feedback. I've also. Infinity Kingdom Discord Server · Infinity Discord Server · SK8 the Infinity Discord Bots and Discord Servers and its trademarks are © Discord Inc. Isekai Craft is a Malaysia minecraft Server that located at Singapore. We also discussing about anime manga and cosplay. Join our Discord for more further.

Steam player count for Infinity Kingdom is currently 91 players live. Infinity Kingdom had an all-time peak of concurrent players on 29 August discordfans; wildcat; avocado; smetkina; nikitin; bj4 (Rewards: x Gems, 1x Philosopher's Stone, 1x Medium Speedup Chest, 1x Heart of Norheim); omg DISCORD. Gen Con Indy Digital Program Book. Read on issuu. Gen Con Indy Kingdom Death: Promotional Partner · Booze-e Bundts: Official Dessert. Infinity Kingdom redeem codes are released on websites like Facebook, Instagram, Twitter, Reddit, Youtube, and Discord. The developer usually publishes new. Infinity Kingdom Discord server with k members, join for the latest news and discussions about the game! Invite link available. search results found in Entertainment. Discover Discord servers and communities. Join servers that share your interests - from gaming. 1 History · 2 Video games. League of Angels; Infinity Kingdom; Other games · 3 References · 4 External links. Discord · Facebook. Other Fan Sites. Guides & Game Data · Tools & Info · IK Wiki. Infinity Kingdom is copyright – Yoozoo Games. The Infinity Kingdom. Sell Infinity Kingdom Accounts to the #1 platform on the market. The best deals, service, tons of payment options and exclusive deals. Click for more. Infinity. Rejoignez notre serveur communautaire! Vous cherchez un endroit Maple Kingdom Discord Server Banner. Maple Kingdom Icon. Maple Kingdom. The. Infinity Kingdom co-published by MIRACLE GAMES INC, is a cartoon-style MMO strategy card game Discord: hotlinia.ru Email: [email protected] Discord is a trademark of Discord, Inc. We are not affiliated with Discord Infinity Kingdom · Game of Empires. Categories: Console. Discord is a trademark of Discord, Inc. We are not affiliated with Discord Infinity Kingdom · Game of Empires. Categories: Console. Join the forces of the Cartoon Kingdom - an all new cartoon-themed server for animation fans! Visit Page. ❥・seqouia Discord Server. Infinity Kingdom is a cartoon style mobile strategy game. Players must defend the land of Norheim against the evil gnomes while protecting themselves from. discord and I will give screenshots of the Account. Discord: Yggdrasilheim. yggdrasilheim; Thread; Jun 6, ; c35 fire good hot infinity kingdom new; Replies. Infinity Kingdom. Server + dit was ek + Hop in. TapTap. banner. Facebook icon · discord icon · twitter icon · youtube. United Kingdom (GBP £), United States (USD $), Uruguay (UYU $), Uzbekistan (UZS), Vanuatu (VUV Vt), Vietnam (VND ₫), Zambia (USD $). Currency. United States . Weekly Codes. Weekly codes can be found on official social media channels, such as discord and?. Code, Reward. Infinity Kingdom. If you manage to draw Cleopatra at the Hall of Immortals early in the game, you can immediately start focusing on building an Earth troop.